Carbon credit vintage year directly influences pricing, buyer confidence, regulatory eligibility, and overall market liquidity. Trading platforms that actively track, analyze, and optimize vintage data gain a decisive competitive advantage.

Most carbon trading systems treat vintage year as static metadata—something to display, not leverage. At Techaroha, we engineer vintage year as a dynamic value driver embedded into pricing logic, compliance workflows, and buyer decision tools.

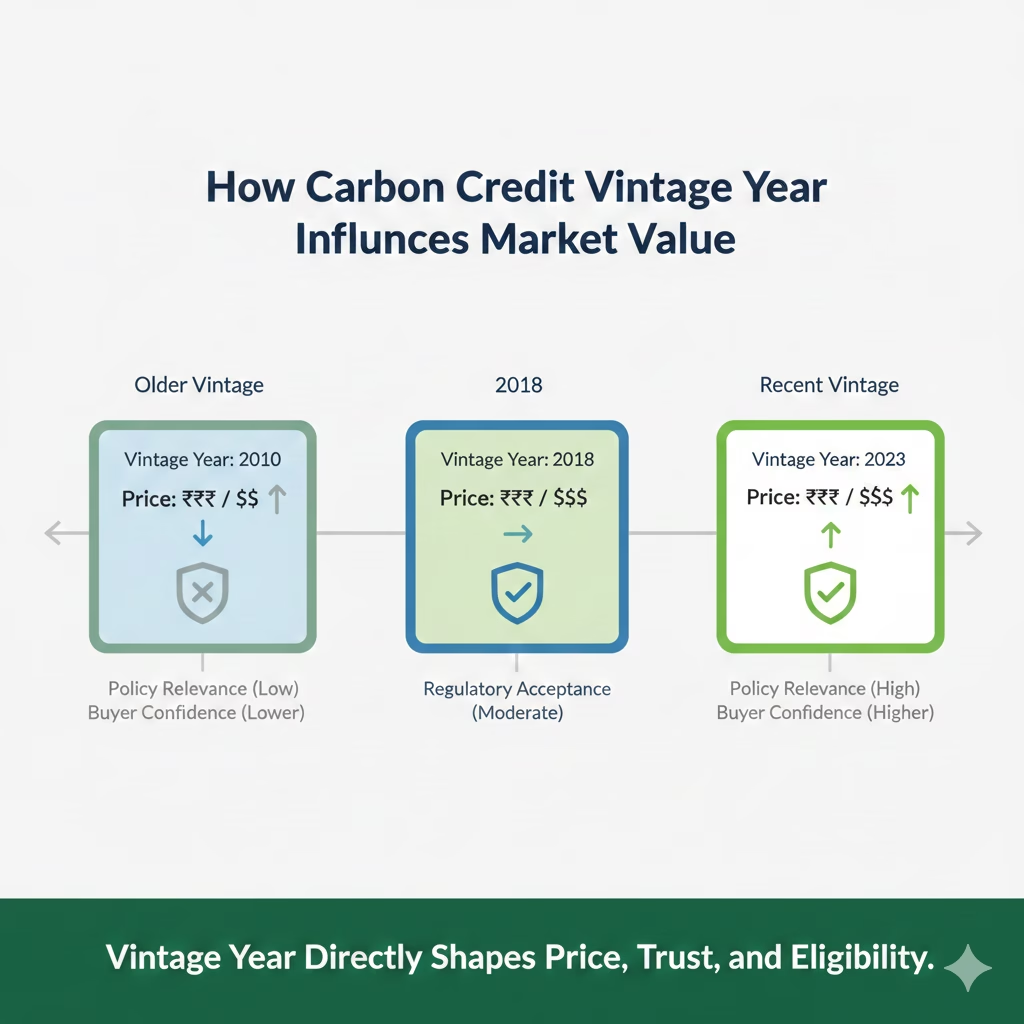

At a basic level, vintage year refers to the year in which the emission reduction or carbon removal occurred. But in real-world carbon markets, vintage year communicates far more than timing.

It signals:

Key insight: Vintage year is not historical context—it is a pricing and trust lever that directly affects transaction outcomes.

As carbon markets mature, scrutiny around credit quality has intensified.

Today:

The result is a fragmented market where two otherwise identical carbon credits can trade at significantly different prices—purely based on vintage year.

Platforms that make this intelligence visible, actionable, and automated don’t just inform users—they earn trust and drive higher-quality trades.

Most carbon trading platforms underperform not because of market demand—but because of how vintage data is handled internally.

Common platform blind spots include:

These gaps lead to systemic inefficiencies:

❌ Poor buyer decision-making experience

❌ Heavy reliance on manual verification and spreadsheets

❌ Reduced buyer confidence and lost trading volume

In effect, the platform becomes a listing portal—not a trading system.

Techaroha architects carbon trading platforms where vintage year functions as an active system variable, not passive reference data.

Our SaaS frameworks are designed to embed vintage intelligence directly into platform logic through:

The result: higher conversion rates, faster trade execution, and improved margin realization across the platform.

When vintage year is treated as structured intelligence, not static information, platforms unlock advanced value-optimization strategies.

With the right SaaS architecture, platform owners can:

This transforms the platform from a passive marketplace into a decision engine—one that actively guides buyers, protects sellers, and maximizes overall market efficiency.

As carbon markets evolve, leading participants are moving beyond generic exchanges and one-size-fits-all marketplaces.

They require platforms that offer:

Techaroha designs and builds white-label, enterprise-grade carbon trading platforms—customized to each client’s vintage rules, compliance frameworks, and growth roadmap.

This platform intelligence is essential if you are:

If vintage year influences your pricing, eligibility, or buyer trust, platform-level intelligence is no longer optional.

Carbon credit markets are maturing—and expectations are rising.

Platforms that treat vintage year as static data will struggle with trust, liquidity, and compliance.

Those that transform it into actionable intelligence will lead the next phase of carbon trading.

Techaroha doesn’t sell a carbon credits platform; we build the systems that make them trade better.

👉 Looking to build or upgrade your own carbon credit trading platform? Let’s architect it together.