The global carbon credit market crossed $2 billion in 2024, yet nearly 73% of small and mid-sized businesses remain locked out. High minimum purchase requirements, rigid contract sizes, and manual trading processes make participation impractical for organizations with modest emissions footprints.

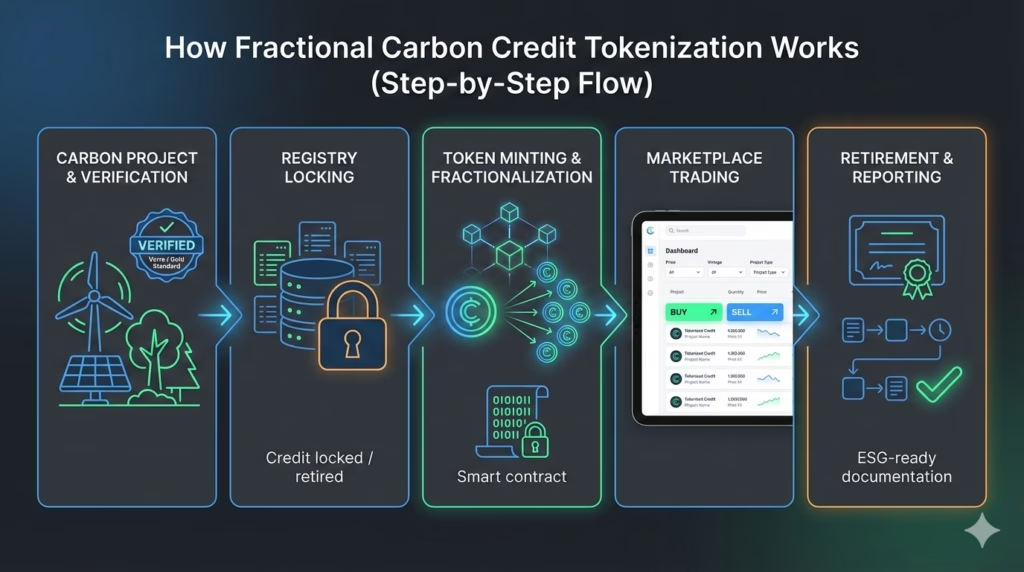

Fractional carbon credit tokenization changes this dynamic by transforming verified carbon credits into divisible digital assets that can be traded, owned, and retired in precise quantities. Instead of purchasing entire credits in bulk, organizations can access carbon markets with accuracy, flexibility, and lower capital commitments—while platform operators unlock new revenue at scale.

This is no longer experimental. Companies deploying tokenized carbon credit platforms are achieving 300%+ ROI within 18 months, expanding buyer access by over 400%, and dramatically improving credit utilization.

Conventional carbon markets were built for enterprise buyers. A typical transaction requires minimum purchases of 1,000 credits or more, translating to $30,000–$50,000 per deal.

For a regional logistics firm emitting 200 tons annually, this means buying five times more offsets than needed—or not participating at all.

According to 2024 market research:

This creates a systemic contradiction: organizations best positioned to adopt sustainability practices are excluded by infrastructure designed for large buyers only.

Fractionalization applies proven financial engineering principles—used in real estate and private equity—to environmental assets.

Instead of selling entire credits, blockchain-based carbon platforms divide a single verified credit into smaller, tradable units.

A café offsetting 0.37 tons per month can now purchase exactly that amount—without overbuying or exiting the market altogether.

For sellers and brokers, this unlocks previously unreachable buyer segments, generating higher transaction frequency and predictable recurring revenue.

A renewable energy project developer launched a tokenized carbon marketplace in Q2 2024 to address three challenges:

One key challenge: registry integration delays slowed initial onboarding.

Solution: parallel registry synchronization and phased token minting reduced future onboarding time by 60%.

Total platform cost: $180,000

First-year net revenue uplift: $750,000

ROI: 316% (excluding multi-year recurring revenue)

Successful platforms rely on four tightly integrated components:

Yes—when implemented correctly.

Fractional tokens do not create new carbon credits. They represent partial ownership of existing, verified credits.

Compliance alignment includes:

Well-designed platforms operate as technical infrastructure, not issuers of environmental claims—ensuring regulatory compatibility.

| Factor | Traditional Markets | Fractional Tokenization |

| Minimum purchase | 1,000+ credits | Any fraction |

| Buyer access | Enterprises only | SMEs + enterprises |

| Liquidity | Low | High |

| Settlement | Manual | Instant |

| Transparency | Limited | On-chain |

This model delivers maximum value for:

If you manage supply, demand, or compliance—owning the infrastructure compounds value.

Beyond transaction fees:

A platform processing $30M annually can generate $1.15M+ from the same infrastructure.

Early entrants benefit from:

Late movers will pay rent to infrastructure owners—or struggle to compete.

Weeks 1–4: Architecture & compliance design

Weeks 5–10: Smart contracts, marketplace, registry integration

Weeks 11–13: Security audits, pilot launch, scale testing

Speed matters. Every month of delay compounds opportunity cost.

The carbon market is consolidating around platform ownership, not participation.

Owning tokenized infrastructure means:

This isn’t just about compliance—it’s about who controls climate market infrastructure.

Is fractional carbon credit tokenization legal?

Yes, when credits are locked or retired at the registry level and fully traceable.

Can fractional credits be retired partially?

Yes. Smart contracts allow retirement of exact fractions.

Which blockchains are best for carbon markets?

Ethereum, Polygon, and enterprise private chains depending on cost and compliance needs.

How do platforms prevent greenwashing?

By linking every fraction to a verified source credit with immutable audit trails.

Get a 30-minute feasibility call—no sales pitch, just numbers.

You’ll receive:

Contact Techaroha today to assess your fractional carbon credit tokenization opportunity.

[Start Your Platform Assessment →]