Imagine a market where pollution carries a price tag and cutting emissions creates tradeable assets worth billions. That’s the carbon credit market-one of the fastest-growing financial ecosystems of our time. With valuations set to soar from USD 1.4 billion today to as high as USD 250 billion by 2050, carbon credits are becoming the next big frontier for investors hungry for profit and impact.

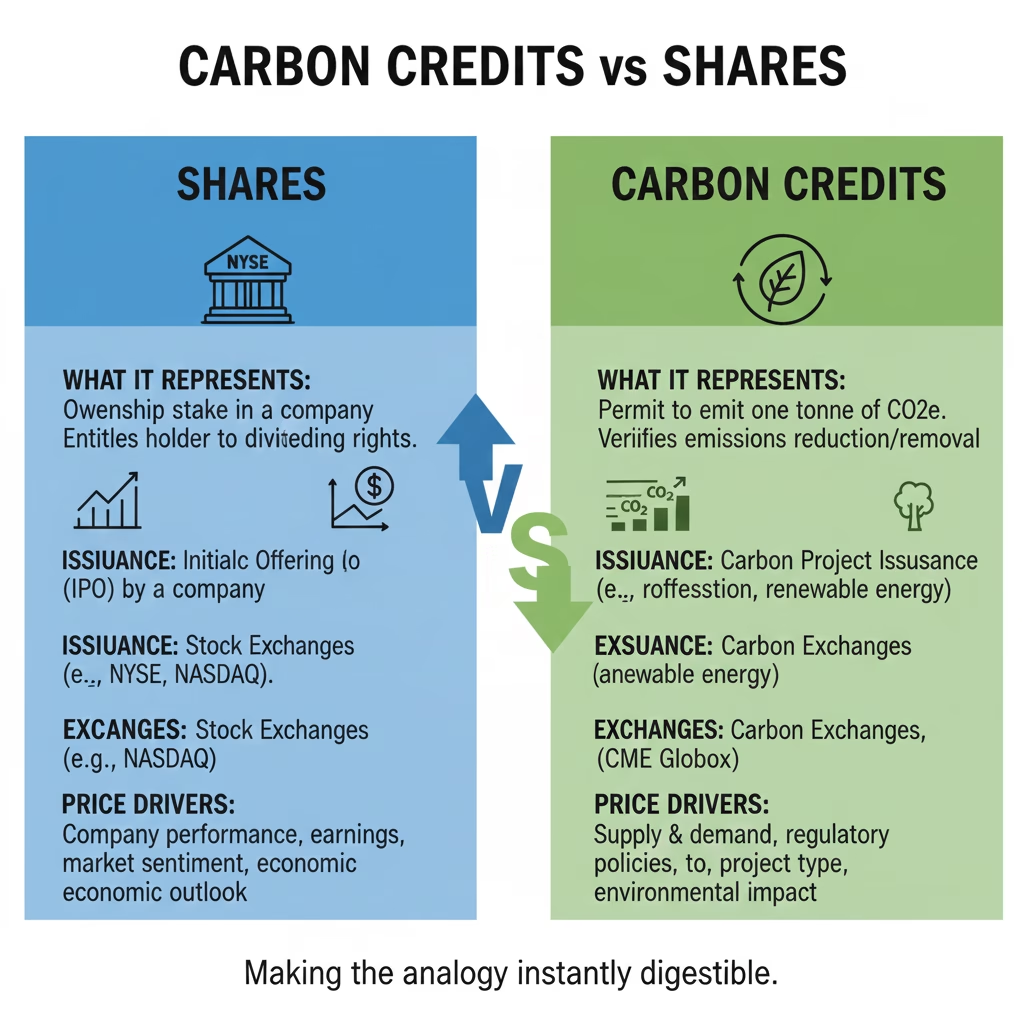

Think of carbon credits as shares in the environment. Just as a stock certificate represents ownership in a company, a carbon credit represents one metric ton of carbon dioxide (or equivalent greenhouse gas) that has been removed from the atmosphere or prevented from entering it.

Here’s where it gets interesting for investors: these aren’t abstract environmental tokens. They’re tradeable financial instruments with real market prices, supply-demand dynamics, and profit potential.

There are two primary types of carbon credits, similar to how the stock market has different classes of securities:

Carbon Allowances (Compliance Market) function like government-issued permits. Governments set a cap on total emissions and distribute allowances to companies, essentially limiting how much they can pollute. If a company emits less than its allowance, it can sell the surplus. If it exceeds its limit, it must buy additional allowances or face penalties. Think of these as regulated securities traded on formal exchanges.

Carbon Offsets (Voluntary Market) work more like corporate bonds-companies voluntarily purchase these credits to offset their emissions by funding projects that reduce or remove greenhouse gases. These credits come from projects like renewable energy installations, reforestation initiatives, or carbon capture technology.

The key distinction? Allowances are about permission to emit (trading pollution permits), while offsets are about compensation for emissions already released (paying for environmental projects elsewhere).

If you understand how stock markets operate, you’ll grasp carbon markets quickly. The fundamental principle is identical: supply meets demand through transparent trading platforms, and prices fluctuate based on market forces.

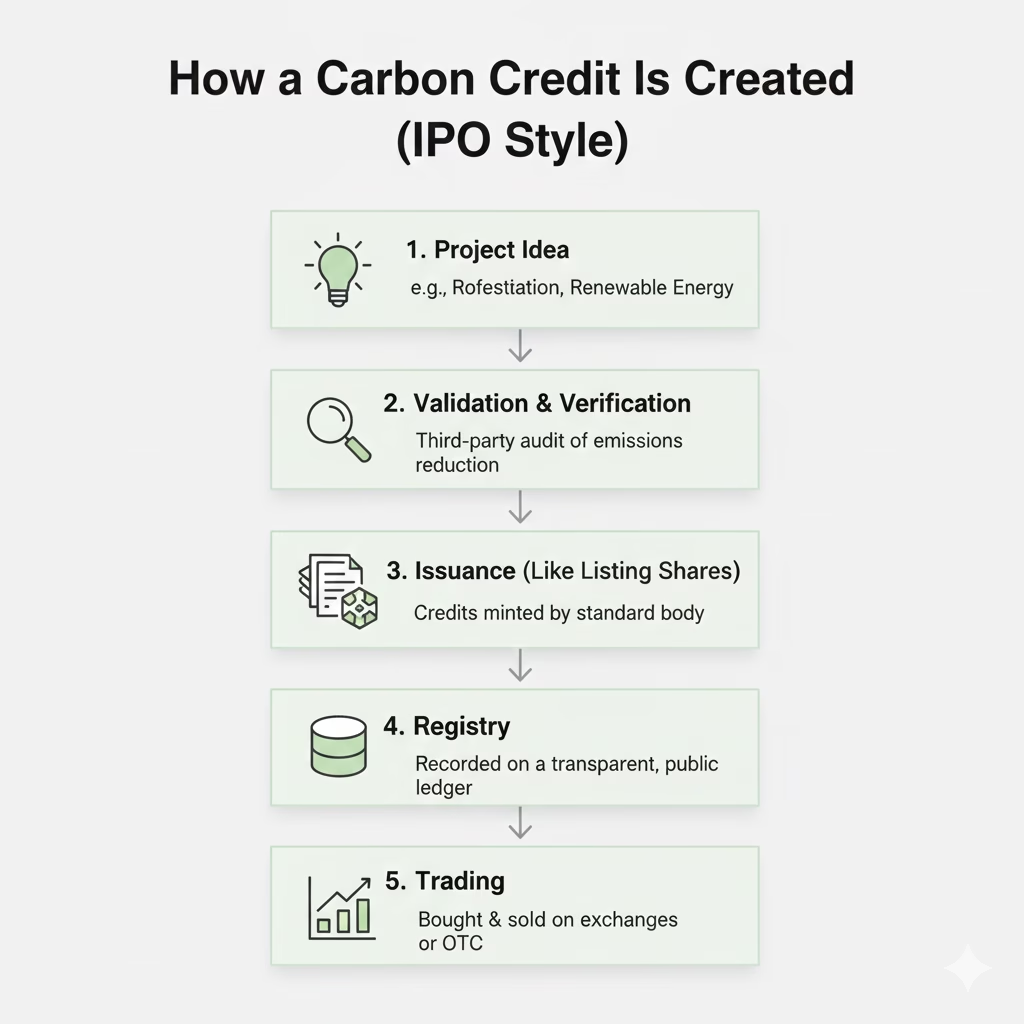

Carbon credits enter the market through environmental projects, similar to how companies enter stock markets through IPOs. Here’s the process:

Project Creation: Developers identify opportunities to reduce emissions-building wind farms, protecting forests, capturing methane from landfills, or implementing energy efficiency improvements.

Validation & Verification: Independent third-party auditors (think of them as the SEC of carbon markets) verify that projects genuinely reduce emissions and meet strict quality standards. This prevents “greenwashing” and ensures credit integrity.

Credit Issuance: For every verified ton of CO2 prevented or removed, one carbon credit is issued with a unique serial number, preventing double-counting.

Market Entry: Credits are listed on registries and become available for trading on various platforms and exchanges.

Multiple buyer categories create demand, each with distinct motivations:

Compliance Buyers: Companies in regulated industries (utilities, manufacturing, aviation) must purchase credits to meet government-mandated emission caps. This creates guaranteed demand similar to dividend-paying utilities-stable, predictable, and growing.

Voluntary Corporate Buyers: Companies like Meta, Apple, and Netflix purchase credits to meet net-zero commitments and enhance their ESG credentials. Tech giants are leading the charge towards net-zero targets by 2030, while major mining companies and energy giants are making similar commitments.

Financial Investors: Hedge funds, banks, and institutional investors trade carbon credits for profit, bringing liquidity and sophistication to the market. Among new entrants in voluntary carbon markets in 2021, oil and gas majors, hedge funds, and banks were among the most active players.

Speculators: Traders betting on future price appreciation, similar to commodity futures traders.

Just as stocks trade on NYSE, NASDAQ, or BSE, carbon credits trade on specialized platforms. The market infrastructure mirrors traditional financial markets with increasing sophistication.

Major exchanges for carbon credits include New York-based Xpansiv CBL and Singapore-based AirCarbon Exchange, which have created standardized products to simplify trading. In 2022, Zerocap partnered with ANZ Bank and Beta Carbon to successfully trade tokenized Australian carbon credits using blockchain technology.

The European Union Emissions Trading System (EU ETS), launched in 2005, remains the most liquid and mature carbon futures exchange. The EU carbon futures market has surged over 1,400% in the last five years, demonstrating the explosive growth potential that early investors have captured.

Other major trading systems include:

Like stocks, carbon credit prices fluctuate based on supply, demand, and market sentiment. However, several unique factors drive valuations:

Quality and Type: Not all carbon credits trade at equal prices. Removal credits (which actively remove CO2 from the atmosphere through technology or nature) command premium prices compared to avoidance credits (which prevent future emissions). Removal credits recently accounted for about a third of retirement value, around USD 500 million, despite historically representing less than 20% of market value.

Vintage Year: The year a credit was issued affects its value. Recent vintages typically trade at higher prices as they reflect current standards and methodologies.

Project Type: Credits from nature-based solutions (forestry, agriculture) often trade differently than technology-based solutions (renewable energy, carbon capture). Investors can choose exposure based on their preferences, similar to selecting growth stocks versus value stocks.

Regulatory Environment: Government policies dramatically impact prices. Stricter emission caps, new climate legislation, or carbon border adjustment mechanisms can send prices soaring.

Market Sentiment: Corporate net-zero commitments, climate conferences, and public awareness all influence demand and pricing.

Current market conditions show interesting dynamics. Average spot prices for carbon credits were around USD 4.8 per tCO2e in 2024, down 20% from 2023, creating potential entry opportunities for value-oriented investors who believe in long-term market growth.

For investors wanting carbon credit exposure, several pathways exist, each with different risk-return profiles:

Purchase credits directly from project developers or through brokers, then hold and sell when prices appreciate. This approach requires understanding project quality, verification standards, and market timing-essentially like picking individual stocks.

Trade futures contracts on major exchanges, locking in prices for future delivery. In 2023, the four largest global carbon futures markets had an annual trading volume of $754.1 billion. Options on futures provide additional flexibility for sophisticated strategies including hedging, spreads, and leveraged positions.

Invest in publicly traded companies operating in the carbon credit ecosystem. Carbon Streaming trades on the NEO exchange in Canada and the OTC market in the U.S., with intentions to list on NASDAQ. Other options include renewable energy companies like Brookfield Renewable Partners and emerging players like DevvStream that provide funding for green projects in exchange for carbon credit rights.

For diversified exposure without picking individual credits or companies, carbon-focused funds offer passive investment options tracking carbon credit price indices or baskets of carbon-related companies.

Several powerful tailwinds support bullish sentiment on carbon credits:

Regulatory Tightening: Governments worldwide are implementing stricter emission caps. As governments and international bodies implement stricter environmental regulations and carbon pricing mechanisms, businesses are incentivized to reduce their carbon footprints. The Paris Agreement and subsequent climate commitments ensure demand will only grow.

Corporate Commitments: By early 2024, 2,732 companies had climate targets validated by the Science Based Targets initiative, representing a 65% increase from the end of 2023. These commitments create structural demand that must be met through credit purchases.

Supply Constraints: High-quality carbon reduction projects take years to develop and verify. As demand accelerates toward 2030 net-zero deadlines, supply scarcity could drive significant price appreciation.

Market Maturation: The carbon credit trading platform market, valued at USD 159.3 Million in 2024, is expected to expand at a 17.7% CAGR through 2034, reaching USD 815.0 Million. Improved infrastructure, standardization, and transparency are attracting institutional capital.

Technological Innovation: Blockchain technology and smart contracts are enhancing market transparency, reducing transaction costs, and making trading more accessible-similar to how digital trading platforms democratized stock investing.

Multiple Revenue Streams: Projects often align with Sustainable Development Goals, adding environmental and social value beyond carbon quantification, potentially creating additional value capture mechanisms.

No investment opportunity comes without risks, and carbon credits present several challenges:

Quality Concerns: Not all carbon credits deliver real environmental impact. Some projects have been criticized for overstating emission reductions or claiming credit for activities that would have happened anyway. Negative publicity about the quality of some projects contributed to cooling the market in 2024.

Regulatory Uncertainty: Carbon markets depend heavily on government policy. Changes in political leadership, shifting priorities, or weakened climate commitments could reduce demand and tank prices.

Market Fragmentation: Unlike mature stock markets with standardized securities and centralized exchanges, carbon markets remain fragmented across different standards, registries, and geographic regions. This creates complexity and liquidity challenges.

Price Volatility: Early-stage markets experience significant price swings. The recent price decline-down 20% in 2024 following a 32% drop in 2023-demonstrates this volatility.

Lack of Standardization: Different verification standards, project methodologies, and registry requirements create confusion and make price comparison difficult-imagine if every stock exchange had different accounting standards.

Greenwashing Risk: Companies purchasing low-quality credits to appear environmentally responsible without making genuine emission reductions damage market credibility and invite regulatory crackdown.

The carbon credit market stands at an inflection point. Current market conditions show flat demand and declining prices, creating what some analysts call a “frozen” market. However, several catalysts could trigger a significant “thaw”:

2030 Deadline Pressure: As corporate net-zero targets for 2030 approach, the gap between companies’ direct emission reductions and their stated goals will widen, forcing increased credit purchases to bridge the difference.

Quality Flight: Corporate buyers increasingly choose higher-quality credits, which cost more than lower-quality alternatives, and some corporations focus almost exclusively on removal credits that trade at higher prices. This trend could bifurcate the market, with premium credits appreciating while low-quality credits become worthless.

Geographic Expansion: China is investing in technological innovation and market development, with an 18.4% forecasted CAGR from 2024 to 2034. The country has implemented pilot carbon trading programs providing valuable market experience.

Sectoral Growth: The utilities sector accounted for 34.1% of market revenue in 2023 and is expected to grow substantially through 2030, as electricity and gas companies rely on carbon credit trading to manage power generation emissions.

Technological Integration: The use of blockchain technology, smart contracts, and artificial intelligence in carbon trading platforms enhances market regularity, uniformity, and transparency, potentially attracting mainstream institutional investors who demand market sophistication.

For investors ready to enter carbon credit markets, several strategies aligned with different risk tolerances make sense:

Conservative Approach: Quality Focus Invest only in verified, high-quality credits from reputable registries with strong environmental integrity. Focus on removal credits from established project types. Think blue-chip stocks-lower returns but more stability and reputational safety.

Growth Approach: Emerging Markets Target credits from developing regions where projects are scaling rapidly. Asia Pacific produces credits while Europe consumes and regulates, creating symbiotic growth opportunities. This approach offers higher potential returns but increased execution and regulatory risk.

Speculative Approach: Futures Trading Trade carbon credit futures and options for leverage and tactical positioning. This demands sophisticated market knowledge, active management, and strong risk controls-essentially day trading carbon instead of stocks.

Diversified Approach: Multi-Asset Portfolio Combine direct credit holdings, carbon-focused equities, and futures exposure across different geographies and credit types. Balances growth potential with risk management through diversification.

Value Approach: Contrarian Timing Current market weakness may present buying opportunities. With prices down significantly from peaks and long-term growth drivers intact, value investors might find attractive entry points-similar to buying quality companies during market corrections.

Before committing capital to carbon credits, conduct thorough due diligence similar to fundamental stock analysis:

Project Assessment: Evaluate the underlying project generating credits. Is the emission reduction real, measurable, and permanent? Does the project have strong verification from recognized standards?

Additionality Verification: Confirm the project wouldn’t have happened without carbon credit revenue. This ensures you’re funding genuine new emission reductions, not subsidizing activities that would occur anyway.

Registry Reputation: Check which registry issues the credits. Established registries like Verra, Gold Standard, or government-run compliance registries provide more credibility than unknown entities.

Pricing Analysis: Compare prices across similar credit types. Are you paying fair market value? What drives price differences between seemingly similar credits?

Counterparty Risk: If buying through brokers or intermediaries, assess their financial stability and reputation. Can they deliver the credits they’ve sold?

Regulatory Alignment: Understand how current and future regulations might affect credit eligibility, pricing, and demand in your target markets.

For modern investors, carbon credits offer something rare: genuine diversification with societal impact. Carbon credit investments show low correlation with traditional asset classes, meaning they can improve portfolio risk-adjusted returns through diversification benefits.

Additionally, carbon prices have shown resilience during inflationary periods because market structure helps drive carbon pricing, potentially serving as an inflation hedge-a valuable characteristic in portfolios.

From an ESG perspective, carbon credit investments align financial returns with environmental impact, addressing growing investor demand for sustainable investment options that generate both profit and positive externalities.

Ready to explore this market? Here’s a practical roadmap:

Education Phase (1-2 months): Study carbon market mechanics, regulations, and standards. Follow market news, price movements, and policy developments. Join industry associations or online communities focused on carbon markets.

Platform Research (2-4 weeks): Identify reputable trading platforms, brokers, or investment vehicles available in your region. Compare fees, credit types available, and regulatory compliance.

Small Position Entry: Start with a small allocation-perhaps 1-3% of your portfolio-to gain practical experience without excessive risk. Test different credit types and trading strategies.

Monitor and Learn: Track your positions closely. How do prices react to news? What drives demand for your specific credits? How liquid is your market?

Scale Gradually: As understanding deepens and confidence grows, consider increasing allocation if performance warrants. Never invest more than you’re comfortable potentially losing in this emerging market.

Carbon credits represent a genuinely new asset class at an early growth stage-similar to where cryptocurrency was in 2015 or renewable energy stocks were in 2005. Early investors captured extraordinary returns but also faced significant volatility and uncertainty.

This market suits investors who:

This market may not suit investors who:

The carbon credit market is rapidly emerging as a powerful investment frontier, driven by corporate net-zero commitments, regulatory momentum, and rising climate awareness. While the space remains fragmented and unpredictable, informed investors can unlock both environmental impact and compelling returns. As carbon pricing becomes inevitable, early adopters will benefit most. The market is open, the transition is accelerating-and the real question is whether you’re ready to invest.