The energy sector stands at a critical juncture where environmental accountability meets operational efficiency. Carbon credit registry software has emerged as a foundational technology enabling energy companies to scale compliance, improve transparency, and unlock faster market access.

When Pacific Energy Solutions implemented carbon credit registry software in Q2 2023, they didn’t anticipate the magnitude of transformation awaiting their carbon trading operations. Within eight months, verification timelines dropped from 45 days to just 72 hours, while administrative costs fell by 68%.

This case study explores how digitizing carbon registries delivers measurable ROI and long-term competitive advantage in today’s compliance-driven energy landscape.

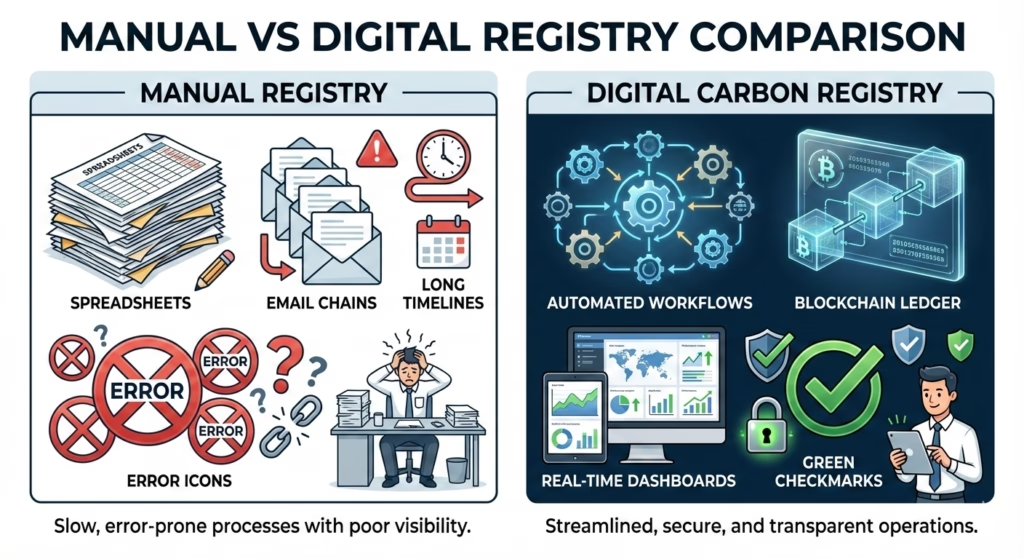

Carbon credit registry software is a digital platform that records, verifies, tracks, and manages carbon credits throughout their lifecycle—from issuance and transfer to retirement.

For energy companies, it replaces manual spreadsheets and fragmented systems with a secure, auditable, real-time registry, often powered by blockchain, automation, and marketplace integrations. The result is faster transactions, lower compliance risk, and improved monetization of environmental assets.

Pacific Energy Solutions, a mid-sized renewable energy provider managing 850,000 carbon credits annually, relied on traditional registry processes riddled with inefficiencies. Their carbon trading desk employed 12 full-time staff to manage spreadsheets, email confirmations, and manual verifications.

They faced three critical challenges:

Beyond direct costs, manual processes caused a 4.7% error rate in credit tracking—creating compliance risk and reputational exposure. When regulatory scrutiny increased in early 2023, leadership recognized that adopting carbon credit registry software was no longer optional—it was essential.

Image Placeholder:

Comparison chart showing manual vs digital carbon credit registry timelines, costs, and error rates.

Pacific Energy partnered with a specialized development firm to deploy carbon credit registry software tailored for the energy sector. The implementation focused on three integrated capabilities.

Each carbon credit received a unique digital identifier with immutable provenance tracking—from generation through retirement. This eliminated dual record-keeping and provided cryptographic proof of authenticity for auditors and buyers.

The platform integrated directly with independent verification bodies. Documentation submission, validation, and approval workflows were fully automated. Once standards were met, credits moved from pending to tradable automatically.

Result: Verification cycles dropped from 45 days to 72 hours (93% faster).

The registry connected to major carbon exchanges, enabling instant price discovery and automated trade execution. Buyers accessed inventory, certification details, and pricing via a unified dashboard—expanding Pacific Energy’s potential buyer base by 340%.

The deployment followed a phased rollout to ensure zero business disruption.

Outcome: First fully automated trade settled in 14 minutes, compared to the previous 11-day average.

Pacific Energy invested $340,000 in carbon credit registry software, covering development, integrations, and training. First-year returns exceeded expectations.

Image Placeholder:

ROI dashboard showing cost savings, transaction speed improvements, and compliance efficiency gains.

Beyond automation, carbon credit registry software delivered strategic intelligence.

CRM-style buyer intelligence improved sales execution:

Scalability proved to be the most powerful long-term advantage.

By 2024, Pacific Energy managed 3.2 million credits—nearly 4x growth—without increasing operational headcount. The carbon credit registry software scaled horizontally, maintaining performance while reducing per-credit management costs.

This technical maturity strengthened Pacific Energy’s market position. In December 2024, it directly supported a $23 million strategic partnership, validating the platform investment many times over.

Delaying adoption of carbon credit registry software creates compounding disadvantages:

Digital capability is no longer a differentiator—it’s the baseline for survival.

To implement carbon credit registry software successfully:

Technology delivers value only when teams fully adopt it.

Pacific Energy Solutions’ transition to carbon credit registry software demonstrates how digitization drives efficiency, revenue growth, and strategic advantage. A 312% first-year ROI confirms that modern carbon registries deliver tangible business results.

For energy companies, the real question isn’t whether to digitize—but how fast. With proven ROI and a 90-day deployment window, early action is the smartest move in a carbon-focused global economy.

Discover how carbon credit registry software can unlock compliance efficiency and new revenue streams for your energy portfolio.

Contact us today for a customized ROI and digital readiness assessment.