Sustainability audits were never designed to generate revenue.

They were created to satisfy regulators, reassure stakeholders, and tick compliance checkboxes.

But the market has changed.

Today, sustainability performance directly influences carbon credit value, ESG financing access, procurement eligibility, and brand trust. In this new landscape, audits are no longer passive documents—they are economic signals. And blockchain is the technology that converts those signals into marketable assets.

For businesses investing in carbon reduction projects, renewable infrastructure, or ESG programs, blockchain-enhanced sustainability audits represent a strategic opportunity: turning verified impact into tradable value.

This article explores how blockchain transforms sustainability audits from static reports into revenue-generating infrastructure, and why companies that act early gain a measurable financial advantage.

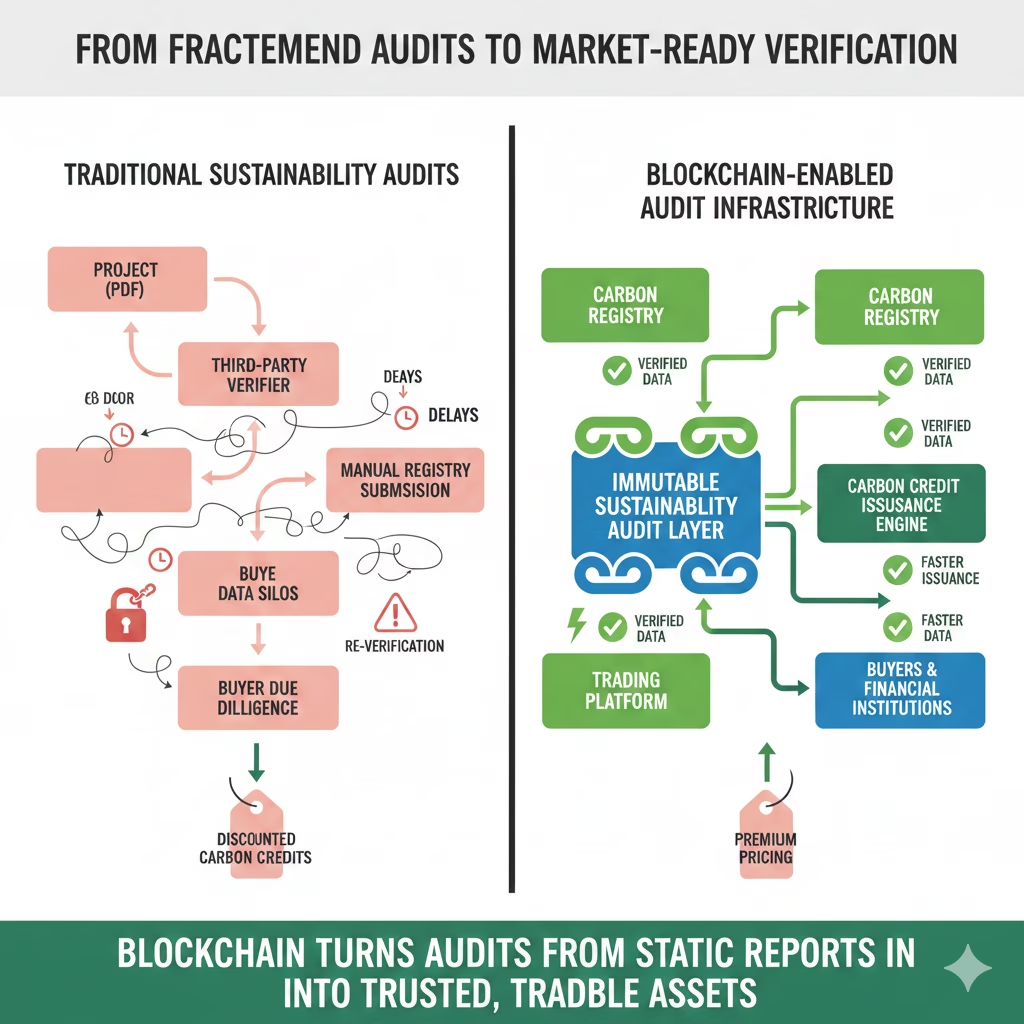

Despite their importance, most sustainability audits still operate on outdated assumptions:

These limitations create friction when audits are used beyond compliance—especially in carbon markets, where every claim must withstand scrutiny from registries, buyers, and regulators.

The result?

In short, traditional audits destroy value the moment they should be creating it.

Blockchain doesn’t just “secure” audit data. It redefines what an audit is.

When sustainability data is recorded on a blockchain:

This creates a single source of truth that can be trusted by:

The audit stops being a snapshot in time and becomes a living, verifiable asset.

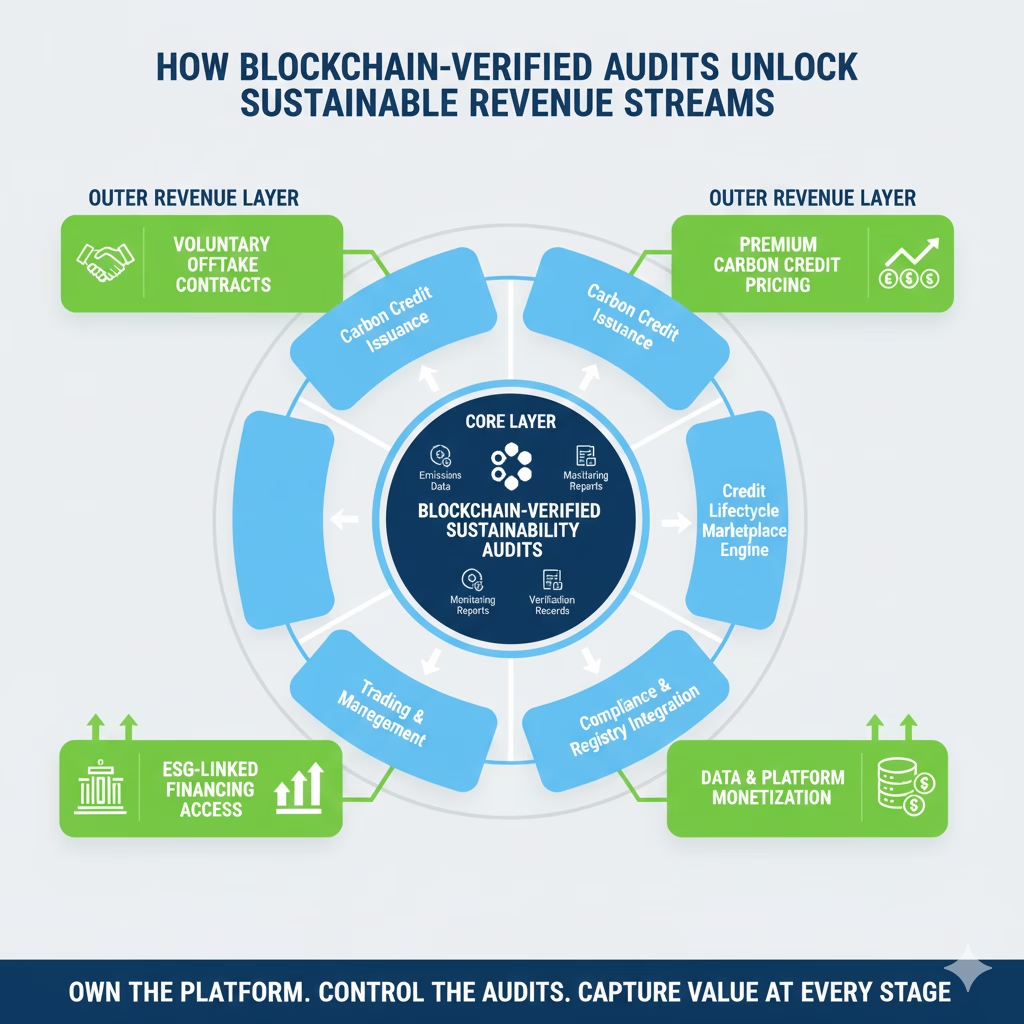

The most important shift blockchain enables is this:

Audits move from “proof of compliance” to “proof of value.”

Blockchain-backed sustainability audits can be directly integrated into:

This integration removes friction between audit completion and monetization.

Carbon markets reward credibility, traceability, and speed.

Blockchain-enabled audits help businesses:

This leads to:

Projects backed by blockchain-verifiable audits often command premium pricing, because buyers face less reputational and regulatory risk.

For project developers, this directly improves credit yield per ton.

Voluntary carbon markets are evolving rapidly. Buyers no longer accept generic offsets—they demand:

Blockchain-enhanced audits enable:

This allows businesses to:

In a market increasingly plagued by trust issues, verified transparency becomes a pricing lever.

Financial institutions are tying lending terms to sustainability performance—but only when that performance is provable.

Blockchain-based sustainability audits:

For businesses, this translates into:

Audit data becomes a financial credential, not just a reporting obligation.

Many organizations attempt to digitize audits using off-the-shelf tools. These systems often fail because they:

Blockchain-based platforms, when custom-built, solve these issues by design:

This is why leading organizations move toward custom carbon credit trading platforms, not generic dashboards.

The biggest opportunity is not just issuing carbon credits.

It’s controlling the infrastructure that produces them.

Businesses that invest in blockchain-enabled audit and trading platforms gain:

Over time, the platform itself becomes an asset—capable of generating revenue through:

Consider a renewable energy developer operating projects across multiple geographies.

Each project undergoes standalone verification, often with different auditors and timelines. Audit data is stored in disconnected systems and must be repeatedly revalidated for every buyer, registry, or financing partner.

As a result:

Despite genuine environmental impact, much of the value is lost to process friction and trust gaps.

Audit data is recorded immutably and integrated directly into a carbon credit trading platform. Emissions baselines, monitoring data, and verification records remain continuously accessible and tamper-proof.

This enables:

The same sustainability effort now delivers higher and more predictable returns, improved market access, and stronger long-term buyer relationships—without increasing operational complexity.

Blockchain doesn’t change the project.

It changes how efficiently value is unlocked from it.

Blockchain alone doesn’t create value.

Value comes from how it’s implemented:

This is why carbon credit trading platform development requires:

Without this, even the best technology fails to monetize impact.

Sustainability audits are no longer a regulatory afterthought.

When powered by blockchain, they become:

Companies that recognize this shift early gain:

The future of sustainability is not about reporting more data.

It’s about proving impact in ways the market can trust—and pay for.

Blockchain-enhanced sustainability audits make this shift possible by turning verification into value, compliance into confidence, and environmental performance into a measurable economic asset.

For businesses serious about carbon markets, ESG leadership, and long-term value creation, the question is no longer whether to adopt blockchain. It’s how strategically to design and implement systems that convert verified impact into sustainable revenue.

This is where platform thinking matters—integrating audits, compliance logic, carbon credit issuance, and trading into a single, scalable infrastructure.

If you’re exploring how to transform sustainability audits into monetizable carbon assets, Techaroha helps enterprises design, build, and implement blockchain-enabled carbon credit trading platforms tailored to real market requirements.

👉 Start the conversation here: Contact Techaroha