Double-counting can inflate reported emission reductions, creating false impressions of climate progress and eroding trust in carbon markets. Studies suggest it could distort up to 30–40% of claimed global carbon offsets. Blockchain offers a powerful solution by recording every credit’s creation, transfer, and retirement on an immutable public ledger—ensuring that once a credit is claimed, it can never be reused or resold.

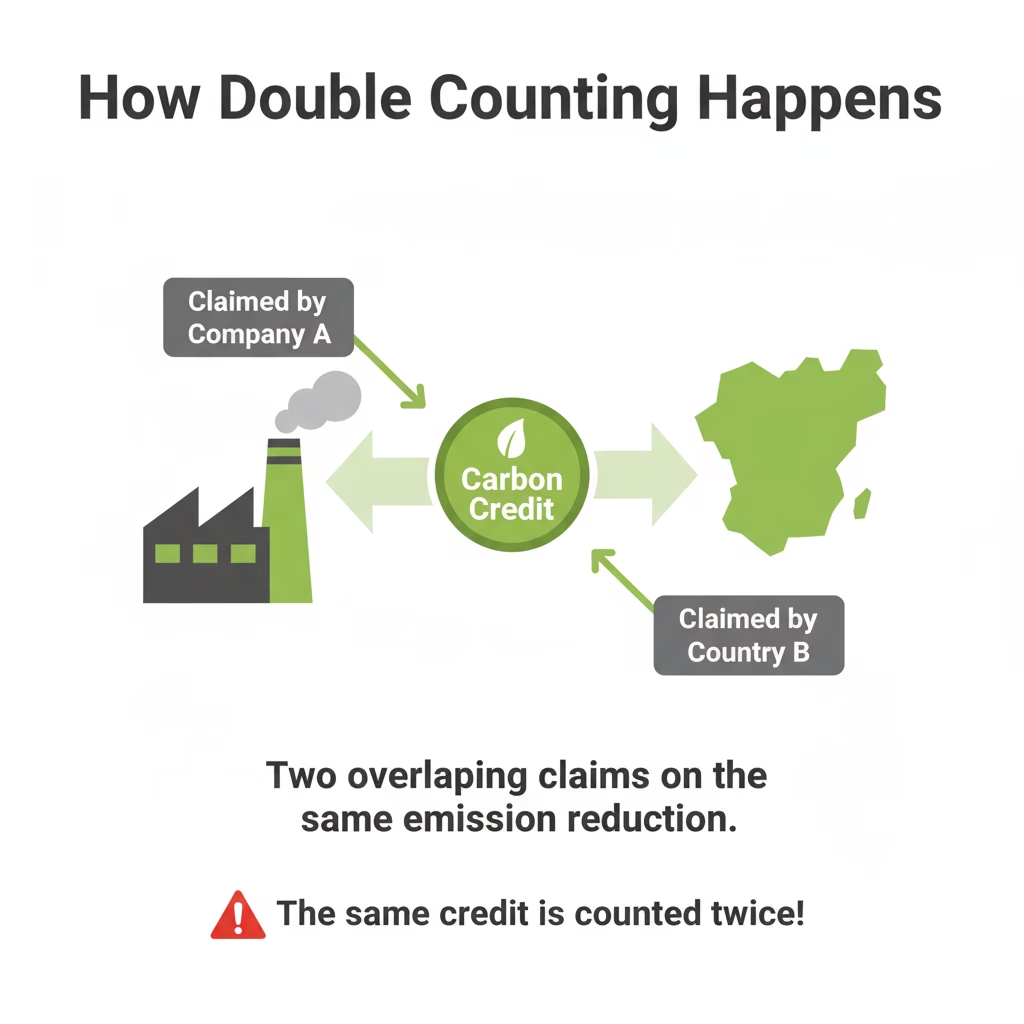

Double counting occurs when the same emission reduction is claimed by two entities or systems, such as a nation and a private company. This undermines the credibility of carbon markets and corporate sustainability reports. Global concerns, especially under the Paris Agreement, highlight this issue. To address it, blockchain introduces unmatched transparency and traceability across registries.

| Mechanism | How It Works | Prevents Double Counting By | Example Use Case |

| Immutable Ledger | Every transaction is recorded permanently | No duplicate entries | Public blockchain registry |

| Unique Token IDs | Each credit = unique digital token | Credit cannot exist twice | NFT-based carbon credits |

| Smart Contracts | Automate credit lifecycle (issue → transfer → retire) | Blocks re-trading after retirement | On-chain auto-lock after use |

| Verification Layers | Third-party verifiers + audits on-chain | Ensures off-chain project integrity | Registry-integrated verification |

| Interoperable Registries | Cross-chain data sync | Prevents the same project from listing twice | IWA / Climate Ledger Initiative |

Traditional carbon markets rely heavily on manual registries and paper-based credit tracking, which leave room for duplication and human error. Fragmented systems with multiple registries and inconsistent standards make it difficult to verify whether a credit has already been issued or sold elsewhere. The lack of real-time transparency further allows governments and private entities to unknowingly claim the same emission reduction, one in a national inventory and another in the voluntary market. These gaps create confusion, reduce market integrity, and set the stage for why blockchain-based systems are essential to eliminate double-counting.

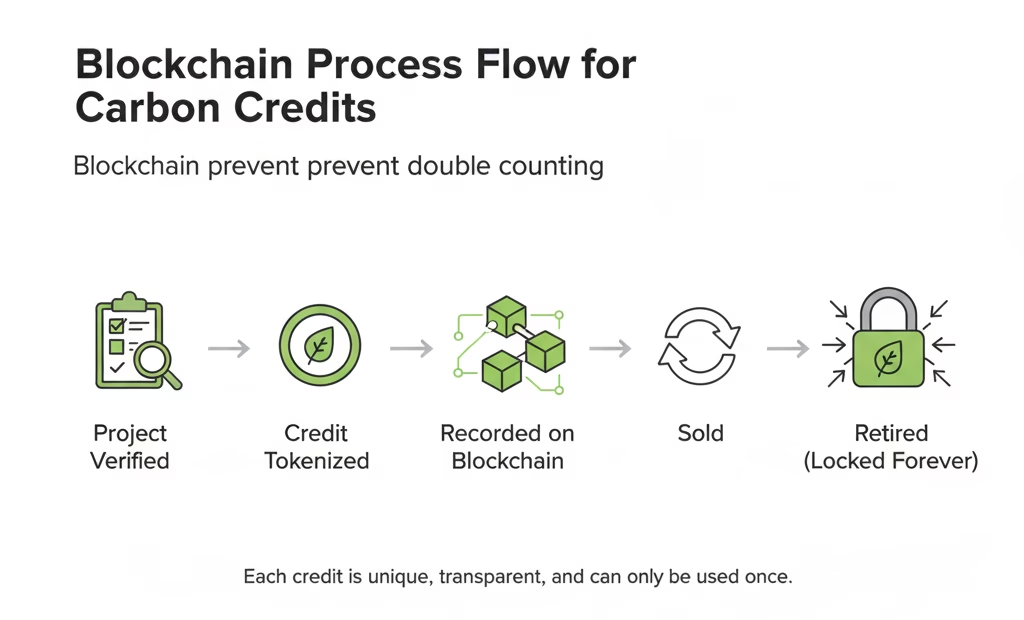

Blockchain operates as a decentralized and immutable ledger, meaning once a transaction is recorded, it cannot be altered or deleted. Every action — from the issuance of a carbon credit to its transfer and retirement — is stored as a time-stamped block shared across all participants. This distributed transparency ensures that each carbon credit’s complete history is visible and verifiable, preventing any chance of the same credit being resold or claimed twice. In short, immutability locks integrity into the system itself.

Each carbon credit on a blockchain is tokenized — often as a non-fungible token (NFT) — that carries a unique digital identity. These tokens include metadata such as the project origin, issuance date, and retirement status. Since identical tokens cannot exist twice on a blockchain, duplication becomes technically impossible. This one-to-one mapping between real-world emission reductions and digital tokens ensures that every credit is traceable, authentic, and unique.

In blockchain-based carbon systems, a smart contract automates the lifecycle of a credit — from issuance to sale and final retirement. “Retirement” means the credit has been used to offset emissions and can no longer be traded. When a buyer claims a credit, the smart contract instantly marks it as retired, locking it permanently. The process follows a simple, tamper-proof flow: Issue → Sell → Retire → Locked Forever. This automation eliminates human error and ensures that once retired, the credit can never re-enter circulation.

While blockchain secures transactions, it doesn’t verify the environmental validity of the credits themselves. That role remains with external auditors and verifiers, who confirm the legitimacy of emission reductions before data is uploaded. Verified documents and reports are then hashed and stored on-chain, creating an unchangeable proof of authenticity. Governance bodies or decentralized autonomous organizations (DAOs) set standards, oversee audits, and ensure compliance. Additionally, oracles connect blockchain systems with off-chain project data, maintaining real-world accuracy. In essence, blockchain ensures transparency, while verification ensures quality.

One of the biggest challenges in carbon markets is fragmentation — different registries, standards, and countries maintaining separate systems. Blockchain addresses this through interoperability, enabling registries to connect via blockchain-based APIs or data bridges. Initiatives such as the Climate Action Data Trust (CADT) and IWA Token Standards are pioneering this integration, ensuring that once a carbon credit is registered on one system, it cannot appear in another. This global visibility eliminates the risk of multiple claims across jurisdictions, paving the way for a unified and trustworthy carbon market.

Several blockchain-based platforms are already working to eliminate double-counting and bring transparency to carbon markets. Toucan Protocol, KlimaDAO, Flowcarbon, Coorest, Carbonplace, and Climate Action Data Trust (CAD Trust) are among the pioneers leveraging blockchain to digitize, tokenize, and track carbon credits securely.

For example, in these systems, when a carbon credit is moved on-chain, its off-chain version is automatically locked in the original registry, ensuring it cannot be duplicated or resold elsewhere. This mechanism creates a clear, tamper-proof audit trail that tracks the credit’s full lifecycle — from issuance to retirement — while maintaining public visibility for buyers and regulators.

Techaroha, through its blockchain innovation in the Carbon Credit Exchange and Planet First Registry, extends this vision by building enterprise-grade platforms that digitize the carbon credit process using blockchain and NFT technology. These solutions enable real-time verification, transparent transactions, and instant retirement tracking, preventing double-counting at every stage of the credit’s journey.

Such systems are already showing measurable benefits — including enhanced registry transparency, reduced administrative errors, and instant traceability — proving that blockchain isn’t just theoretical but a practical tool to rebuild trust and integrity in global carbon markets.

The next phase of blockchain integration aims to build a unified, global carbon registry—a single interoperable backbone that eliminates double counting across regions and standards. By connecting registries through shared protocols, transparency can become the norm rather than an exception.

Future systems may integrate IoT sensors and satellite data to automatically validate emissions and project outcomes in real time—reducing dependence on manual verification. Governments are beginning to explore this shift, signaling a move toward digitally verified carbon credits that could become part of international climate reporting frameworks.

With companies like Techaroha and others pioneering blockchain-based carbon systems, the vision of an open, verifiable, and collaborative carbon ecosystem is taking shape. But achieving it will require sustained collaboration between governments, registries, and technology providers to standardize protocols, share data securely, and ensure trust at a global scale.

Q1. Can a blockchain-based carbon credit be sold twice?

No. Once a carbon credit is tokenized and recorded on the blockchain, every transaction is tracked on an immutable ledger. When a credit is sold or retired, it is permanently marked as used — preventing any chance of resale or duplication.

Q2. What happens when a carbon credit is retired?

Retirement means the credit has been claimed to offset emissions. On the blockchain, this status is automated through smart contracts — once retired, the credit becomes non-transferable and is locked forever on the ledger.

Q3. How do NFTs represent carbon credits?

Each carbon credit can be represented as a unique NFT (Non-Fungible Token). The NFT contains metadata such as project details, issuance date, and retirement status, ensuring every credit is unique and traceable throughout its lifecycle.

Q4. Does blockchain verify emission reductions itself?

No. Verification still depends on accredited third-party auditors. Blockchain simply ensures that once verified data is added, it remains transparent and tamper-proof.

Q5. How can blockchain prevent double counting across countries?

By connecting different national and voluntary registries through blockchain-based APIs and shared standards, governments and private buyers can view the same record — ensuring that no emission reduction is claimed twice.

Blockchain is emerging as the digital proof-of-integrity layer for the global carbon market.

While it doesn’t replace traditional verification, it enhances transparency, traceability, and trust — ensuring that every carbon credit is authentic, unique, and permanently accounted for.

As adoption grows, blockchain technology could eliminate double-counting, restore confidence, and lay the foundation for a truly unified, transparent carbon offset market.

👉 To learn more about how Techaroha is building blockchain-powered carbon credit management solutions, click here to explore our carbon systems.