The voluntary carbon market reached $2 billion in 2024, yet over half of rainforest offset projects show signs of fraudulent activity. For enterprises investing millions in carbon neutrality strategies, this creates a multimillion-dollar risk exposure. The fundamental question sustainability officers now face isn’t whether to participate in carbon markets, but how to ensure every credit purchased represents genuine emissions reduction.

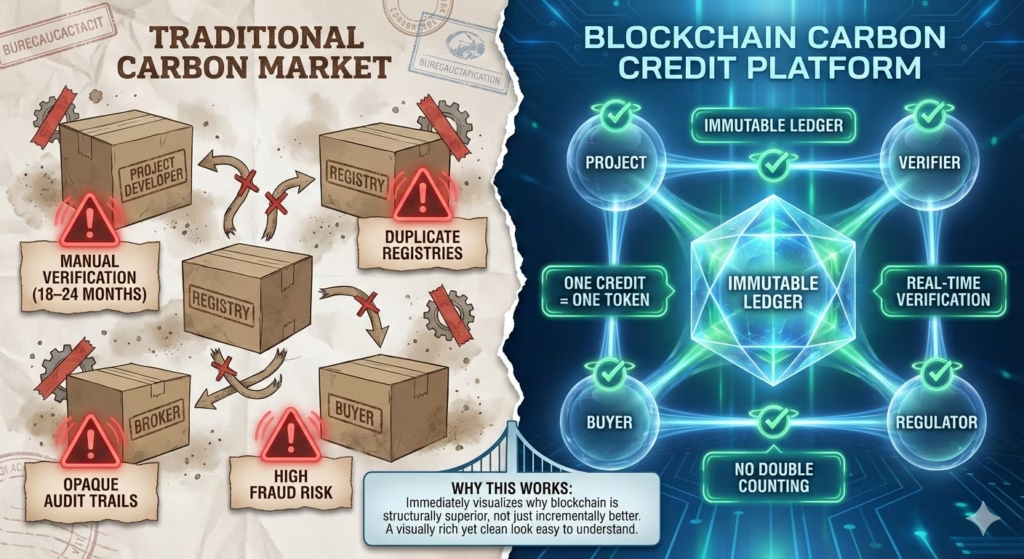

Traditional carbon credit systems operate through fragmented registries, manual verification processes, and opaque trading mechanisms. This architecture creates systematic vulnerabilities: the same emission reduction gets claimed by multiple parties, verification can take 18-24 months, and audit trails disappear across registry boundaries. When a European manufacturing company recently discovered 30% of their purchased offsets were duplicated across three different projects, their board mandated a complete platform overhaul.

This isn’t a compliance problem. It’s an infrastructure problem requiring an infrastructure solution.

Traditional carbon markets struggle because they rely on slow, fragmented, and opaque systems. This creates three major problems.

With the carbon market expected to reach $250 billion by 2030, these problems will only grow if the system does not change.

Blockchain fixes the core weaknesses of traditional carbon markets by changing how carbon credits are created, tracked, and retired. Instead of relying on trust and manual checks, it uses code, cryptography, and automation.

Immutable ledgers stop double-counting at the source.

Each carbon credit is tokenized on the blockchain with a unique digital ID that cannot be copied or reused. Smart contracts enforce single ownership and one-time retirement. Once a credit is used, it is permanently recorded and cannot re-enter the market. This removes the risk of the same credit being sold multiple times.

A European carbon exchange adopted this model in 2023. Over one year, it processed 4.3 million credits worth $86 million with zero double-counting incidents. Under its old system, it handled dozens of disputes every month. Cryptographic verification replaced manual reconciliation.

Smart contracts dramatically speed up verification.

Traditional verification can take 18–24 months due to paperwork, inspections, and approvals. Blockchain platforms automate this process by integrating satellite data, IoT sensors, and third-party auditor inputs. When predefined conditions are met, credits are issued automatically.

In Brazil, an agricultural carbon project reduced issuance time from 16 months to just 11 days after moving to a blockchain-based system. This allows project developers to access capital faster and enables buyers to procure credits when they are actually needed.

End-to-end provenance ensures full transparency.

Every step—from project registration to final retirement—is permanently recorded on-chain. This creates a complete, tamper-proof audit trail.

For companies facing stricter climate disclosure rules, blockchain provides verifiable proof that carbon claims are real, compliant, and defensible.

A global industrial manufacturer with $12 billion in annual revenue faced a critical problem in Q1 2024. Their sustainability roadmap committed to carbon neutrality by 2030, requiring annual offset purchases of 2.3 million metric tons. However, their procurement team had identified significant fraud risk in their existing supplier network.

The Challenge: Unverifiable Carbon Credit Supply Chain

Their traditional procurement process involved purchasing credits from three major brokers, who sourced from 40+ underlying projects across 15 countries. The manufacturer possessed no visibility into project verification, ownership history, or retirement status. When preparing their annual sustainability report, legal counsel flagged potential greenwashing liability: the company could not prove with certainty that any purchased credit represented genuine emissions reduction.

Board-level sustainability governance requirements demanded a solution that provided:

The Implementation: Custom Blockchain Carbon Platform

The organization partnered with a specialized blockchain development firm to build an enterprise carbon credit trading platform with four core components.

A tokenization engine converted verified carbon credits from established registries (Verra, Gold Standard, ACR) into blockchain-based digital assets. Each token mapped 1:1 to a registered credit, with metadata including project type, vintage year, verification methodology, and geographic location. The tokenization process automatically retired the original registry credit to prevent duplicative use.

Smart contract verification protocols connected to third-party data sources: satellite imagery for forestry projects, IoT sensors for renewable energy installations, and government emissions databases for industrial efficiency programs. When project milestones were achieved, oracles transmitted verified data to the blockchain, triggering automated credit issuance based on pre-approved methodologies.

An enterprise-grade trading interface integrated with the company’s procurement platform. Sustainability managers could search available credits by project type, price, and impact metrics, execute purchases through the platform, and automatically generate retirement documentation for reporting purposes. All transactions received cryptographic signatures and permanent ledger recording.

A regulatory compliance module generated audit-ready reports linking each offset purchase to specific emission sources, retirement transactions, and project verification records. This documentation integrated directly with the company’s ESG reporting systems and provided export capabilities for SEC filings and investor relations materials.

The Results: 94% Faster Verification, Zero Fraud Incidents

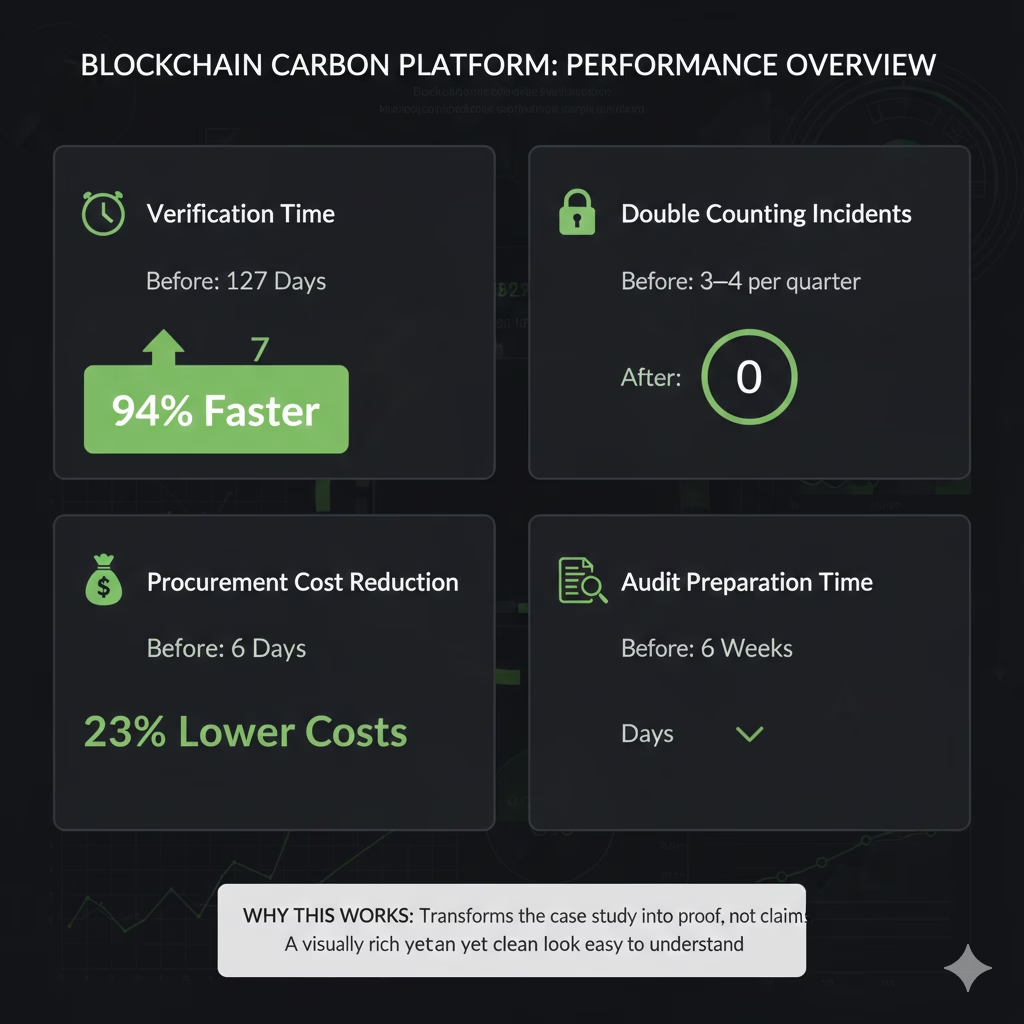

Six months after platform deployment, the manufacturer had processed $8.3 million in carbon credit transactions representing 1.4 million metric tons of offsets. The operational improvements exceeded initial projections across all measured dimensions.

Verification time decreased 94%—from an average of 127 days under the previous broker-based model to 7 days on the blockchain platform. This acceleration resulted from automated smart contract execution replacing manual documentation review. The sustainability team could now procure credits immediately before quarterly reporting deadlines instead of maintaining expensive inventory buffers.

Double-counting incidents fell to zero. Under the legacy system, the organization averaged 3-4 disputed credits per quarter where verification revealed the same underlying reduction had been sold to multiple buyers. The blockchain platform’s cryptographic token system made this technically impossible—each credit existed as a unique digital asset that could only be retired once.

Procurement costs decreased 23% through disintermediation. By purchasing directly from project developers via the blockchain platform rather than through brokers, the company eliminated two layers of markup. Project developers received higher payments, the manufacturer paid lower prices, and the eliminated middlemen absorbed the efficiency gains.

Audit preparation time for sustainability reporting decreased from 6 weeks to 3 days. Instead of compiling paper documentation across 40+ projects and three broker relationships, the compliance team exported cryptographically verified transaction records directly from the blockchain. External auditors could independently verify all claims through public ledger access.

The platform’s transparent architecture provided an unexpected strategic benefit: investor confidence. During Q2 earnings calls, analysts specifically questioned the company’s carbon neutrality claims following recent fraud investigations in the voluntary carbon market. The CFO directed them to the blockchain explorer where all offset purchases and retirements were publicly verifiable. This demonstration of technical transparency contributed to a 2.3% share price increase in the following trading session.

The technical complexity of blockchain carbon platforms creates a qualification gap that procurement teams often misidentify.

Blockchain development expertise doesn’t equal carbon market competence. A development firm that built successful DeFi or NFT platforms won’t necessarily understand emissions accounting methodologies, registry integration protocols, or voluntary carbon market standards. The carbon credit domain requires specialized knowledge of additionality testing, baseline determination, leakage calculation, and permanence verification.

When evaluating development partners, assess their team’s familiarity with standards frameworks: Verra’s VCS methodology, Gold Standard protocols, Climate Action Reserve protocols, or ACR standards. Request case studies demonstrating integration with established carbon registries, not theoretical blockchain implementations.

Off-the-shelf solutions cannot address enterprise governance requirements. Public blockchain carbon platforms offer accessibility but sacrifice control. Enterprise organizations require: private permissioned networks for sensitive transaction data, customizable smart contract logic for specific compliance requirements, integration with existing ERP and procurement systems, and dedicated technical support for mission-critical operations.

A manufacturing company that initially deployed a public platform discovered they could not enforce procurement policies through smart contracts, resulting in unauthorized credit purchases by regional offices. After migrating to a custom enterprise platform, policy enforcement became automated at the protocol level.

Technical implementation represents 40% of project success—change management determines the remaining 60%. The most sophisticated blockchain platform fails if sustainability teams don’t adopt it, procurement officers don’t trust it, or executives don’t understand its value. Development partners should provide: comprehensive training programs for all user roles, clear documentation of processes and workflows, ongoing technical support and platform evolution, and strategic consulting on market participation.

Three organizational characteristics indicate strong ROI from custom blockchain carbon platform development.

If your organization meets these criteria, the strategic question isn’t whether to implement blockchain carbon infrastructure—it’s how quickly you can deploy it before competitors gain first-mover advantages in transparent sustainability reporting.

Enterprise blockchain carbon platform deployment follows a structured four-phase methodology.

Phase 1: Requirements Definition and Architecture Design (Weeks 1-3)

Technical teams collaborate with sustainability officers, procurement managers, legal counsel, and compliance staff to document requirements: carbon credit types and sources, verification methodologies and standards, procurement workflows and approval processes, reporting requirements and audit formats, integration touchpoints with existing systems.

Blockchain architects design the technical stack: public vs. private blockchain selection, smart contract logic for credit issuance and retirement, oracle integration for external data verification, user interface mockups for different roles, security protocols and access controls.

Phase 2: Platform Development and Registry Integration (Weeks 4-8)

Development teams build core platform components: tokenization engine for credit conversion, smart contracts for automated verification, trading interface for procurement operations, reporting module for compliance documentation, API connections to carbon registries.

This phase includes establishing partnerships with carbon registries for data access, configuring oracle services for automated verification, and conducting security audits of smart contract code.

Phase 3: Testing and User Training (Weeks 9-11)

Quality assurance teams execute comprehensive testing: smart contract functionality under various scenarios, integration with existing enterprise systems, performance under expected transaction volumes, security penetration testing, user acceptance testing with actual sustainability team members.

Parallel training programs prepare all user groups: sustainability managers learn procurement workflows, finance teams understand budget tracking, compliance officers master reporting tools, executives receive dashboard demonstrations.

Phase 4: Production Deployment and Monitoring (Week 12+)

Initial production deployment begins with controlled pilot: limited transaction volume, restricted user access, enhanced monitoring and support, rapid iteration based on user feedback.

After pilot validation, full production launch includes complete transaction migration, full user base onboarding, and ongoing platform optimization. Development partners should provide 12+ months of technical support, platform enhancements, and strategic guidance as carbon market conditions evolve.

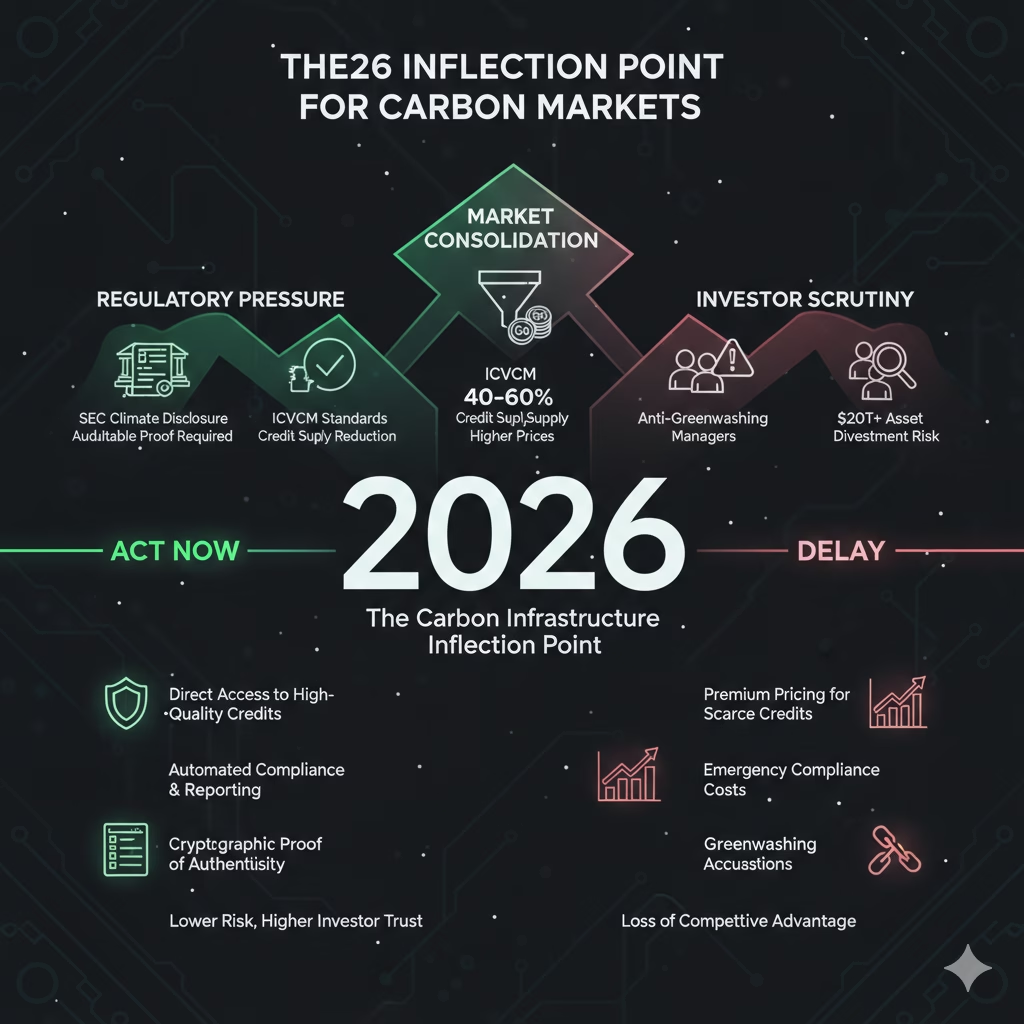

Three converging market forces make 2026 a critical decision year for carbon platform infrastructure.

Organizations that implement blockchain carbon infrastructure in 2026 establish competitive moats: lower procurement costs through direct project access, faster regulatory compliance through automated documentation, enhanced investor confidence through transparent verification, and reduced legal risk through eliminated fraud exposure.

Organizations that delay face escalating costs: premium pricing for shrinking high-quality credit supply, expensive emergency compliance implementations under regulatory pressure, reputational damage from greenwashing accusations, and competitive disadvantage against first-movers.

If your organization purchases 50,000+ carbon credits annually, operates under climate disclosure regulations, or faces investor pressure on sustainability claims, blockchain infrastructure migration isn’t a future consideration—it’s a 2026 priority.

The carbon credit market is undergoing infrastructure transformation. Organizations that rebuild their trading platforms on blockchain architecture will dominate the next decade of climate finance. Those that maintain legacy systems will increasingly find themselves purchasing expensive, questionable credits in an increasingly transparent market.

The technical foundation you build in 2026 will determine your competitive position for the next 10 years. Make it count.

About TechAroha: We specialize in blockchain-based carbon credit trading platform development and implementation services, helping enterprises eliminate fraud, reduce procurement costs, and build regulatory-grade sustainability infrastructure. Our platforms have processed $200M+ in verified carbon transactions with zero double-counting incidents.