While most businesses see blockchain-based carbon credit marketplaces as a compliance checkbox, forward-thinking enterprises are recognizing something far more valuable: the infrastructure itself is the opportunity.

Here’s what nobody tells you: when you trade carbon credits on third-party platforms, you’re not just paying transaction fees—you’re surrendering control of a revenue-generating asset. These platforms capture the spread, own the customer relationships, and extract value from every transaction that flows through your carbon reduction efforts.

But what if you flipped the script?

The voluntary carbon market is projected to reach $120 billion by 2030. The question isn’t whether this market will grow—it’s who will own the infrastructure that captures that value.

Consider this model: Instead of being a participant in someone else’s marketplace, you become the marketplace operator for your industry vertical, supply chain, or geographic region.

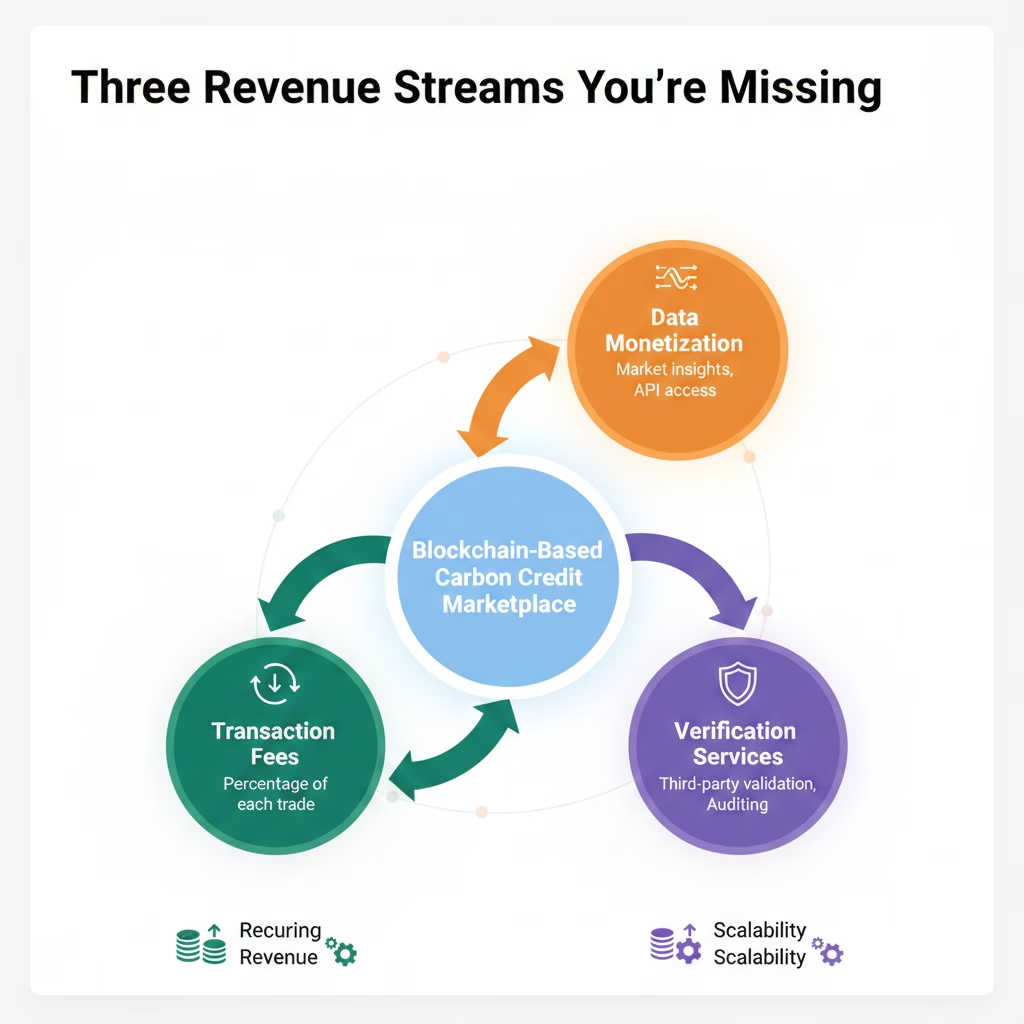

1. Transaction Economics at Scale

Every trade generates 2-5% in transaction fees. A mid-sized industrial platform processing just $50M annually in carbon credits generates $1-2.5M in pure transaction revenue—before considering the appreciation of any credits you hold.

But here’s where it gets interesting: unlike traditional financial exchanges, carbon platforms benefit from network compounding. As more participants join your ecosystem, liquidity improves, spreads tighten, and trading volume accelerates exponentially. Your supplier who trades $500K today could be trading $5M within three years as their own supply chain onboards. Each new participant doesn’t just add their volume—they multiply the potential connections and transactions across the entire network.

2. Data Monetization (The Silent Goldmine)

Blockchain-based platforms generate unprecedented transparency into carbon reduction activities. This data—anonymized and aggregated—becomes incredibly valuable for:

Companies like Chainalysis built $1B+ valuations essentially selling blockchain data insights. Your carbon marketplace generates similar proprietary intelligence.

The real power lies in predictive analytics. You’re not just recording what happened—you’re sitting on behavioral patterns that predict which industries will need credits six months ahead, where pricing pressures will emerge, and which carbon reduction technologies deliver actual ROI. Investment firms, insurance companies, and corporate strategists will pay premium rates for these forward-looking insights that only a platform operator can generate.

3. The “Toll Bridge” Model

Position your platform as the verification layer for your industry. Every carbon claim that needs credibility verification flows through your infrastructure. You’re not just trading credits—you’re becoming the trusted certification layer that competitors must use to establish credibility. This creates a defensible moat that’s nearly impossible to disrupt once established.

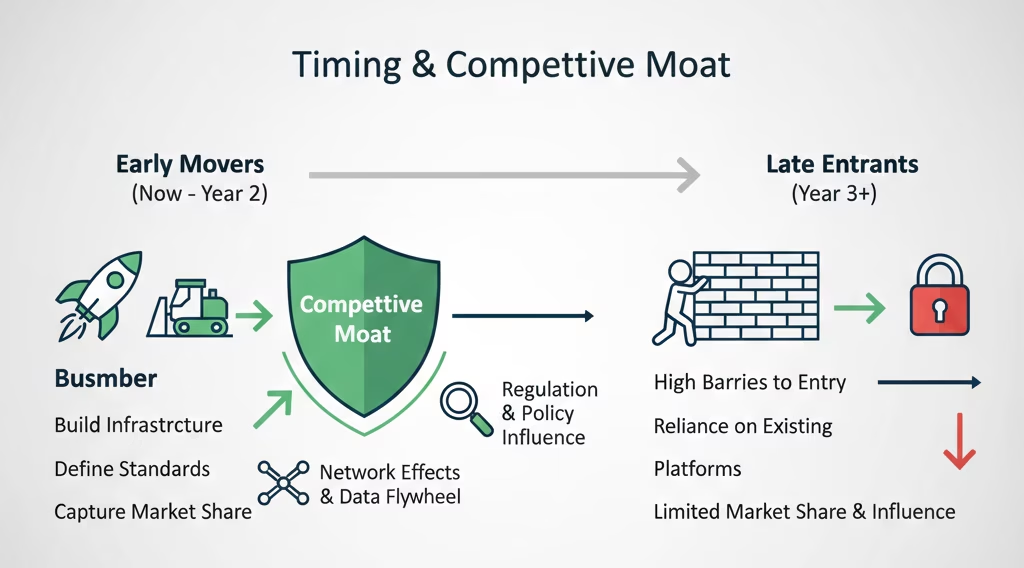

Traditional carbon markets failed because of opacity, fraud, and double-counting. Blockchain solves these problems, but here’s the critical insight: the technology is mature enough to deploy, but early enough that market positions aren’t locked in.

The window is now. In 24-36 months, dominant platforms will emerge in each vertical, and the barrier to entry will become prohibitively expensive.

Yes, regulatory uncertainty is a risk—but it’s also an opportunity. Regulators are actively looking for credible private sector solutions to standardize. Early platform operators have the opportunity to shape standards rather than adapt to them.

The EU’s Carbon Border Adjustment Mechanism and California’s Cap-and-Trade program both emerged from collaboration with early market infrastructure providers.

Here’s the framework we use with clients:

Build your own platform if:

Partner with existing platforms if:

The middle ground: Commission a white-label platform that you control but don’t build from scratch. This captures 70% of the upside at 30% of the development cost.

Before investing millions—or waiting until competitors move first—smart enterprises start with one critical question:

“Is there a carbon marketplace opportunity hidden inside our existing ecosystem?”

In most cases, the answer is yes—but it’s rarely obvious without a structured assessment.

A focused 90-day opportunity assessment can uncover:

Most enterprises don’t need a platform immediately — but they do need clarity before the market decides for them.

Enterprises that complete this assessment typically discover one of two outcomes:

Both outcomes save time, capital, and strategic missteps.

Early movers don’t just launch platforms—they define standards, onboard partners first, and embed themselves into regulatory and reporting workflows. Once that position is established, competitors are forced to connect to your infrastructure—not the other way around.

If carbon credits will touch your business in the next 3–5 years, platform ownership must be a strategic discussion today—not a compliance reaction tomorrow.

👉 The smartest first step isn’t building. It’s validating the opportunity while the window is still open.

Carbon markets are consolidating around infrastructure owners.

If you delay:

By the time platforms become “obvious,” the moat is already built.

The carbon credit market isn’t just about environmental compliance—it’s about who controls the infrastructure of climate capitalism. Third-party platforms want you to be a user. But with blockchain technology now accessible and proven, there’s never been a better time to become the platform.

The companies building these systems today aren’t just preparing for regulation. They’re positioning themselves to profit from it.

Contact Us: Techaroha